Ski Travel Insurance

For some, winding through fields of powdery, white snow extends far beyond a hobby – it’s a lifestyle. But whether you’re one such person, or just an individual in search of a holiday, taking out travel insurance for skiing is a must. While you’re likely to come back safe, failing to get skiing travel insurance isn’t a risk worth taking.

Do I need Ski Travel Insurance?

It doesn’t matter whether you’re a first-time skier or an experienced one. By its very nature skiing is unpredictable, so regardless of experience level, there will always be an element of risk. This is why it is important to take out ski travel insurance, to protect yourself against an eventuality that may arise during your trip. Our Ski Travel Insurance is created by experts who understand the intricacies and requirements of the sport, allowing us to offer specific cover. So, you can hit the slopes, with peace of mind that you’re fully protected.

Skiing Insurance Policy Benefits

Our Skiing travel insurance is part of our winter sports range, this policy includes;

- Single trip and Multi trip policies, with a range of cover levels available

- Winter Sports travel insurance policies

- Cover for European, UK and Worldwide trips

- Cover for several different scenarios, including piste closure, piste rescue, medical emergencies, loss of belongings and cancellation

- Cover for both on and off-piste skiing in resort – regardless of your experience levels

- Cover for various winter sports and other trips

- Automatic discount for couples

As you’re discovering, our skiing travel insurance cover provides holidaymakers – both experienced on the slopes and not – with a safety net which ensures they’re financially secure should the unlikely occur. Don’t run the risk.

Skiing safety tips for beginners

If you’re an experienced hand on the piste, you’ll know most of the basic tips which will help to keep you out of harm’s way when you’re skiing. For less confident first-timers, there are a number of safety tips which will help you to cope with your first time.

- Stopping – It might surprise you to learn you can’t just stop wherever you like. Doing this might put you in immediate harm’s way. Never come to a standstill if you’re obstructing a trail, or aren’t visible to skiers headed your way.

- Yielding – Just like with a car, certain people and “lanes” have a right of way. Anyone in front of you takes precedence when it comes to priority, and it’s your job to make sure you avoid them. Similarly, when you merge onto a trail, make sure to yield to others who are already headed that way.

- Rules – Trails have laws for a reason. However confident you’re feeling, it’s important you stick to the rules set out by those who’ve created the course. Failing to do so could see you or those around you put in harm’s way unnecessarily.

- Alcohol – Never ski while intoxicated. Having alcohol in your system will affect your judgement and reaction times. Unsurprisingly, this can have disastrous consequences when on the slopes. Again, just like with driving, it’s important not to ski while you’re in this state – even if you feel only mildly light-headed.

- Falling – There are right and wrong ways to fall. As a beginner, there’s a good chance you’ll be doing a lot of this – so it’s important to do it properly. The key takeaway with this is to ensure you don’t try to stay upright if you’re already on your way down. Doing so can cause you to jar your legs, leading to more serious injuries than the average crash.

If you’re trying skiing for the first time, it’s important to keep these handy tips in mind. They’ll make a big difference when it comes to staying safe and making your journey as fun and hassle-free as it possibly can be.

What are the Benefits of our Ski Travel Insurance?

As you’re probably already discovering, there are a great many advantages to taking out insurance ahead of a ski trip. Some of the most important include:

- Cancellation cover – Sometimes plans fall through. If this is out of your control, and you’ve already pre-paid for the likes of accommodation or transport hire, you’ll potentially be able to claim it back (or at least some of it) with a travel insurance policy in place. It’s important to check your policy details first, and not just assume you’ll be covered.

- Loss of possessions – If something goes missing (and you weren’t directly responsible), you may be able to claim compensation. In the case of ski travel insurance, this refers to the likes of equipment, baggage and personal documents (such as passports or other forms of ID).

- Accidents – You’ll probably be fine – but accidents do happen. If this is the case, your policy will provide you with cover for medical expenses and treatment. As these costs can reach as high as the thousands, it’s important you are able to foot the bill one way or another. Travel insurance is likely to be the only viable way of doing this.

- Legal advice – Let’s face it, very few of us are legal experts. It will help a great deal to have professional help should something go awry. That’s why Holidaysafe has teamed up with Slater and Gordon when it comes to ensuring you’re guided through any legal process with ease.

Travel insurance as a whole brings with it a series of immense benefits. Make sure to take some out before your next trip to Aspen, the Alps or any other resort which offers you the chance to let your hair down on the slopes.

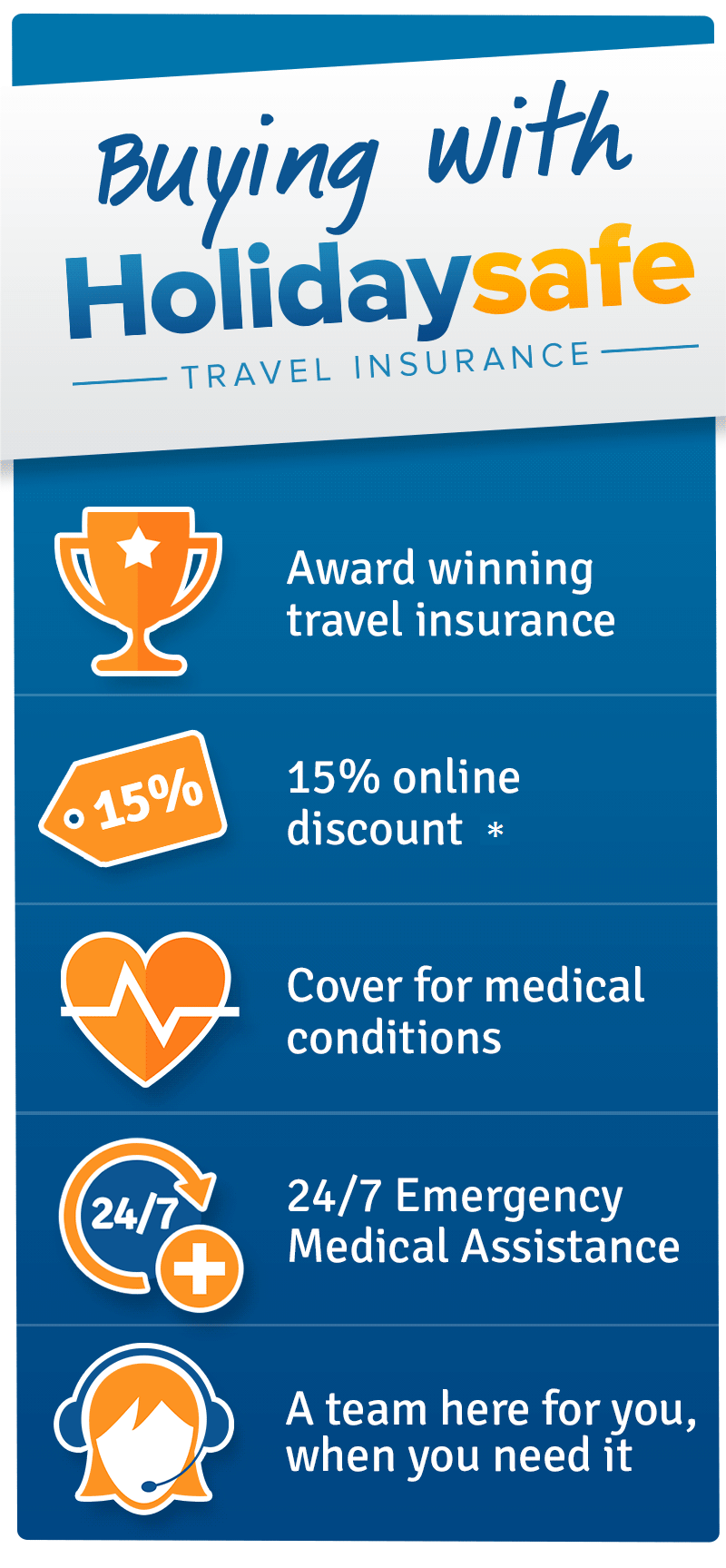

Why Holidaysafe?

- Holidaysafe has been featured in the Which? Travel Insurance review tables since 2010. To view the Which? table of results including their Best Buy travel insurance policies, click here

- Award-Winning Travel Insurance*

- Save 15%Ɨ Online

- 24/7 Emergency Medical Assistance

- Discount on Couples & Family Policies

- 4.6/5 Stars on Google Business*

- FREE and SECURE Customer Area

And Much More

Award Winning Travel Insurance

- Travel Insurance Provider of the Year at the National Insurance Awards 2025*

- Winner for 'Best Family Travel Insurance Provider 2024' in the 2024 SME UK Finance Awards*

- Finalists for 'Digital Broker of the Year' in the 2024 Insurance Times Awards*

- Finalists for ‘Best Travel Insurance Provider’ in the 2022 Insurance Choice Awards*

More Info

Ski insurance cover for all ability levels

Skiing has such a wide appeal that ski travel insurance needs to be able to cater for a diverse range of people. This can make it hard to find the right product. Don’t despair, Holidaysafe is run by people who love to ski and as such have put together the insurance you need regardless of whether you are an adrenaline junkie or going on a family-friendly holiday.

As well as covering you for all of the skiing aspects of your holiday such as avalanche closure, equipment cover and liability our ski holiday insurance also covers medical expenses, cancellation, cutting short your trip, legal expenses, personal possessions and baggage delay and personal money cover.

Skiing safety tips and advice

Making sure you are safe on the slopes is key when it comes to skiing. It’s important to remember a few key rules whilst on the slopes:

- Snowboarders and skiers turn differently. Snowboarders tend to turn sharper, especially when making a heel edge turn, make sure you are keeping an eye out for snowboarders on the slopes.

- Boundary limits are set for a reason, you’re taking safety into your own hands if you are thinking of going off course. Signposts should keep you within the boundaries.

- Beginner? We advise taking lessons to get you going on the slopes. You’ll still have time to ski with your friends after the lessons are complete.

- Know your limits, if you’re new to skiing or a little rusty make sure you’re comfortable with the level of the run before moving up.

FAQs

Does your ski insurance offer off-piste skiing?

Our winter sports policy covers off-piste skiing for no additional premiums if contained within the resort. ‘In-resort’ is defined as an area which has prepared ski runs and groomed slopes and is serviced by lifts and tows which operate seasonally.

Is mountain rescue included in my cover?

Where deemed medically necessary, mountain rescue is included within the insurance policy. Review the medical emergency section of the policy for more details.

I’m going on a ski season, Do I need ski insurance or long term insurance?

For extended periods of time away, a ski insurance policy might not be right for you. If in doubt, contact us to discuss your insurance options.