Annual Multi-Trip: What does Annual Multi Trip mean?

This is a policy type that will cover you all year round for an unlimited number of trips, providing the length of each trip doesn’t exceed the maximum duration limit.

Most Annual Multi-Trip policies will cover you for 31 days maximum duration, but we also provide cover for trips of 45 and 60 days, depending on the level of cover you purchase.

Baggage: What is meant by baggage in a travel insurance policy?

Each of your suitcases, trunks and similar containers (including their contents), possessions and items you wear, carry or use, that are taken on or purchased during a trip by you, (other than those specifically excluded in your policy wordings). Baggage usually includes sports equipment such as golf clubs, winter sports, equipment, scuba equipment and mobility aids such as wheelchairs, unless stated otherwise by your policy.

Cancellation Cover: What is cancellation cover?

Cancellation cover provides cover for costs you’ve paid if you have to cancel a trip because of a sudden and unexpected event that affects you, a close relative or a travelling companion (please check your policy wordings for specific reasons that you are covered for).

Single Trip cover – cancellation cover will begin from the cover start date shown on your policy schedule and end when you begin your trip.

For Annual Multi-Trip cover – cancellation cover will begin on the cover start date shown on your policy schedule or the date you booked your trip (whichever is later) and ends when you start your trip (or when your policy cover ends if this date is earlier and you do not renew your policy).

Claim: You make a claim when you ask your insurer to pay you the sum of money that’s owed to you under the terms of your insurance policy.

Curtailment (cutting your trip short): What does curtailment mean?

If you need to cut your trip short and return home before your original return date, this would be classed as curtailment.

Generally, cover for curtailment will allow you to claim back a pro-rata refund of any pre-paid accommodation, car hire or holiday excursions you will no longer be able to use following your return home.

Some policies will also cover reasonable travel expenses you’ve had to pay on your return home unless your return trip has been arranged for you by your travel insurer. Your insurance policy will allow you to claim back expenses if you are at a financial loss.

Please check your policy wordings for the specific reasons that you can cut your trip short and make a claim for.

Coronavirus Cover: What is coronavirus cover?

Coronavirus cover is cover added into policies specifically to cover situations to do with coronavirus or COVID 19. Cover can be included as standard in policies, or available as an extension or add-on to your standard policy cover. Cover can include different situations, including catching coronavirus abroad and requiring emergency medical care or repatriation to the UK, or having to cancel your trip if you’ve tested positive for COVID 19 prior to your trip.

Emergency medical expenses: What are emergency medical expenses in travel insurance used for?

Within a travel insurance policy, emergency medical expenses provide cover for unexpected emergency medical treatment costs and to arrange to get you back home if you’re too unwell to continue your trip (please note that emergency medical treatment costs are not available if you only have UK cover because the NHS will cover these).

Generally, no cover will be provided if you’re travelling to receive treatment or get medical advice or if you know you’ll need treatment while you’re away.

Check your policy wordings for more specific details around the cover and the amount you can claim for.

European Cover: When you purchase your policy, you’ll be asked about either your destination country or the destination region you are travelling to. European cover is cover for travel in destinations in Europe only. If you were to travel outside of these destinations with only European cover on your policy, and if something were to happen which resulted in you making a claim, your claim could be declined on the basis that you were travelling outside of your selected destination.

The countries listed are:

Albania, Andorra, Austria, Azores, Balearic Islands, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Canary Islands, Channel Islands, Croatia, Cyprus, Czech Republic, Denmark, Egypt, England, Estonia, Finland, Former Yugoslav Republic of Macedonia, France, Germany, Gibraltar, Greece, Greek Islands, Hungary, Iceland, Ireland, Isle of Man, Italy, Kosovo, Latvia, Liechtenstein, Lithuania, Luxembourg, Madeira, Malta, Moldova, Monaco, Montenegro, Morocco, Netherlands, Northern Ireland, Norway, Poland, Portugal, Romania, Russia west of the Ural mountains, San Marino, Scotland, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Tunisia, Turkey, Ukraine, Wales and Vatican City State.

Excess: What is an excess?

The excess is the amount you must pay towards a claim before any payment will be made and is shown on your policy schedule. This amount applies to each claim but does not apply to all sections of the policy. Please refer to your policy wordings for the full terms and conditions.

Exclusions: Exclusions are things that your insurance won’t cover. Please refer to your policy wordings for full details of your policy’s exclusions.

Extension: What are travel insurance extensions?

Extensions are additional levels of cover that you can add on to your policy. For example, if you are planning on taking part in sporting activities on your holiday, you can add a sports extension.

FCDO (Foreign, Commonwealth and Development Office): What is the FCDO?

Formerly known as the Foreign & Commonwealth Office (FCO), and commonly called the Foreign Office (FO), is a department of the Government of the United Kingdom.

Force Majeure: What is force majeure?

Force Majeure is an event that happens outside of your control, including natural disasters, civil unrest, ‘acts of God’ and any other unforeseeable event that could disrupt your trip.

Gadget: What is defined as a gadget in travel insurance?

Gadgets include; Mobile/ Smart Phones, Laptops, Tablets, Digital Cameras, MP3 Players, CD/DVD Players, Games Consoles, Video Cameras, Camera Lenses, Bluetooth Headsets, Satellite Navigation Devices, PDAs, E-Readers, Head/Ear Phones, Portable Health Monitoring Devices, Wearable Technology.

Insurer: An insurer is a provider of insurance.

Legal Costs: What is defined as legal costs within travel insurance?

Legal costs are fees, costs and expenses (including Value Added Tax or equivalent local goods and services taxes) that we agree to pay for you in connection with legal action. Also, any costs that you’re ordered to pay by a court or arbitrator (other than damages, fines and penalties) or any other costs we agree to pay.

Legal Action: Legal action means settlement negotiations, hearings in a civil court, arbitration and any appeals resulting from such hearings that we’ve agreed to. This doesn’t include any application by you to the European Court of Justice, European Court of Human Rights or similar international body.

Policy: Your policy is a formal, legally-binding contract of insurance that includes the terms of your cover.

Policyholder: The person named as the policyholder on the schedule – usually the person who takes out the policy.

Possession Cover: What are defined as possessions within travel insurance?

Your possessions (anything other than your valuables, electrical items and gadgets). This cover can include cover for clothes, shoes and luggage.

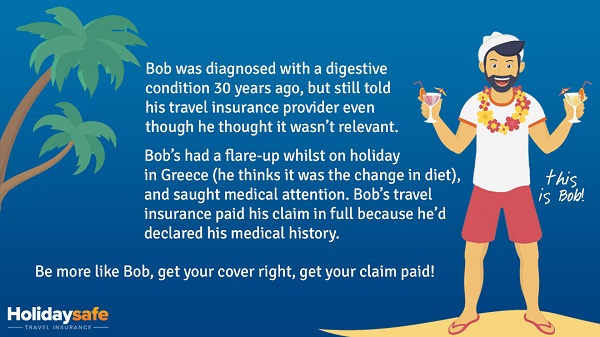

Pre-existing medical condition: Any serious or recurring medical condition which has been previously diagnosed or been investigated or treated in any way, at any time before travel, even if this condition is considered to be stable and under control.

Renewal Date: The renewal date is the date that the policy cover on your multi trip policy will end unless you renew and continue the policy cover. You can renew by retrieving your quote online, or by contacting us.

Single- Trip: Single trip travel insurance, also known as single trip holiday insurance, means cover for just one holiday. Your trip is from the trip start date to the cover end date shown on your schedule. If you return home before your cover end date, all cover will also end.

Terrorism: Terrorism is an act or threat of action by a person or group of people, whether acting alone or in connection with an organisation or government, committed for political, religious, ideological or similar purposes intended to influence any government or to frighten the public or any section of it. An ‘action’ means violence, property damage, putting life in danger, creating a public health risk, or disrupting electronic systems or transport services.

Please check your policy wordings for policy specifics.

Travel Insurance: Travel insurance is insurance coverage for risks associated with travelling such as loss of luggage, delays, and death or injury while in a foreign country.

Trip: A journey that takes place during the period of cover which begins when you leave home and ends when you get back home, or to a hospital or nursing home in the United Kingdom, whichever is earlier.

Valuables: What is defined as valuables within travel insurance policies?

Rings, watches (excluding smart watches), necklaces, earrings, bracelets, body rings, any semi or non-precious stones or metals, costume jewellery and any electrical item that is not a gadget that requires power either from the mains or from a battery.

Winter Sports: Specific sports and activities undertaken on a wintersports holiday.

Some of these activities include:

- Skiing (on and off-piste)

- Snowboarding

- Husky Dog Sledding

- Ice Hockey

- Ice diving

- Ice Skating

- Sledging/Tobogganing

- Sleigh riding

- Snow Mobile/Ski-Doos

- Snow Parascending

- Snow Tubing

Worldwide Cover: This is cover for travel anywhere in the world.